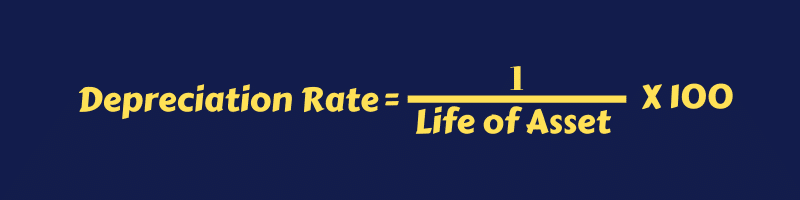

Diminishing depreciation rate formula

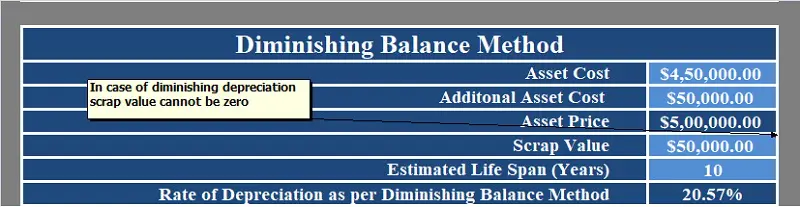

The diminishing balance method is also known as the declining balance method. Depreciation 500000 x 10100 x 912 37500.

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Depreciation 416250 x 10100 41625.

. Diminishing Balance Method Example. And the residual value is. Example of Diminishing Balance Method of Depreciation.

Formula to Calculate Depreciation Value via Diminishing Balance Method. How do you calculate diminishing rate. Cost value 10000 DV rate 30 3000.

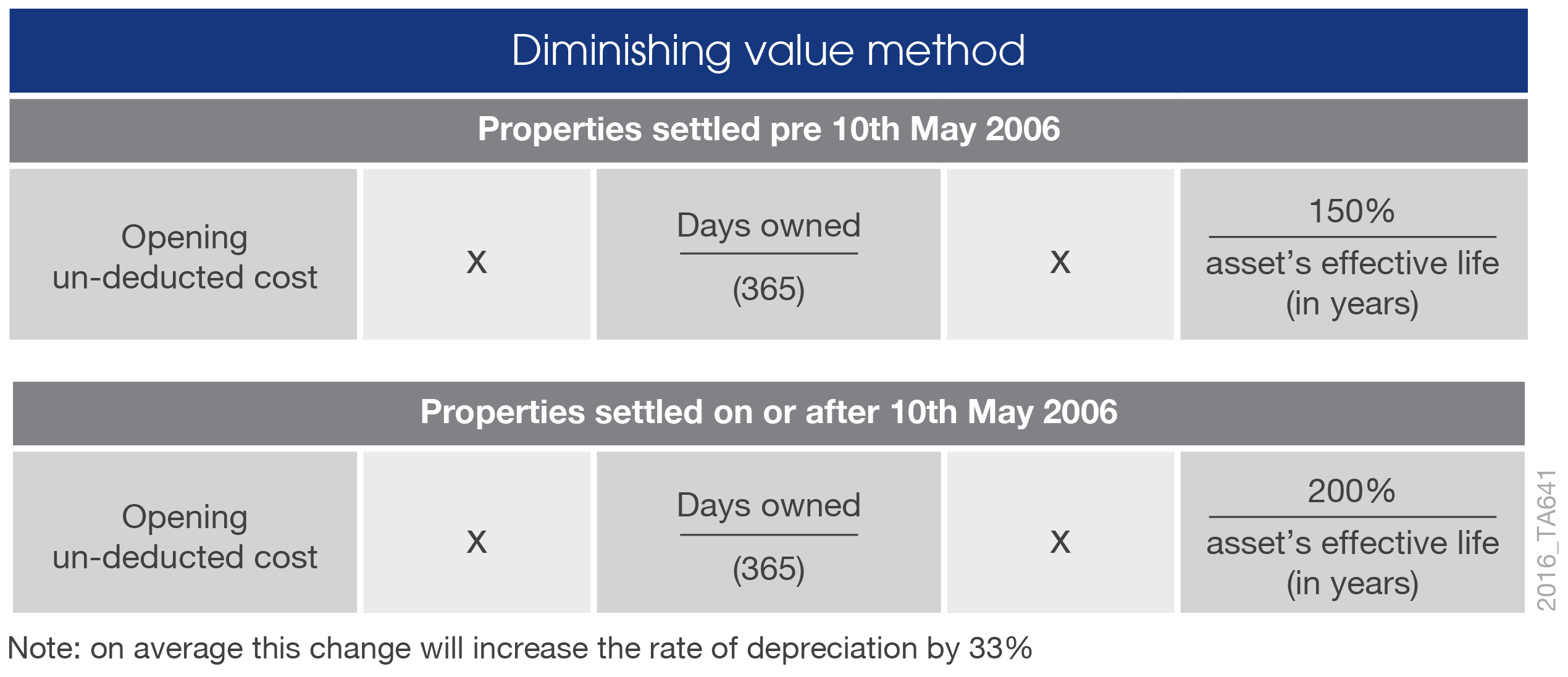

The diminishing balance method is used for computing depreciation on an asset. Depreciation 374625 x. Rate Adjustments - Diminishing Value Depreciation Method Example.

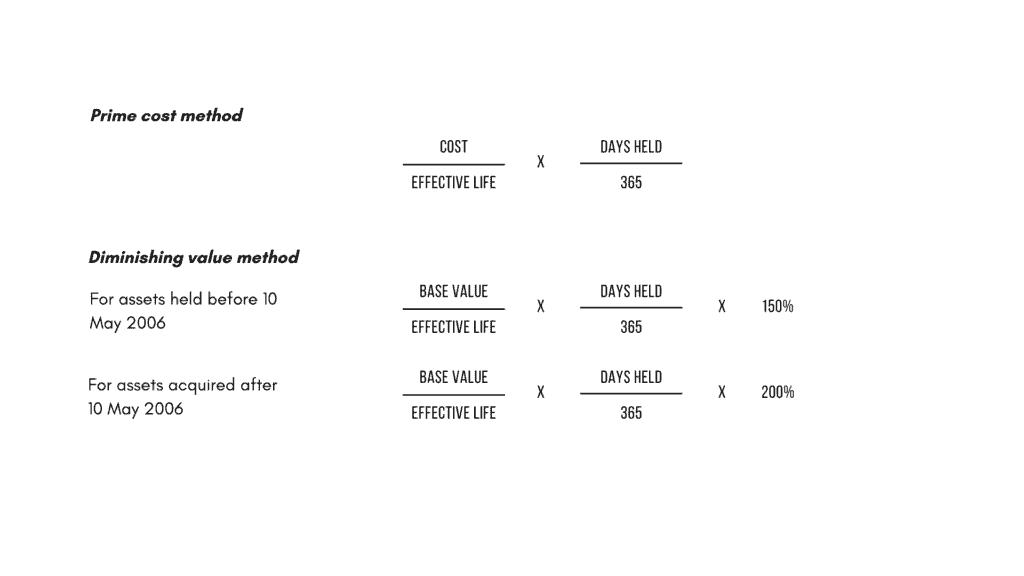

Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. In this video we use the diminishing value method to calculate depreciation. 100000 and its scrap value after the useful life is 0.

Depreciation amount 1750000 12. Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much. Depreciation amount opening balance depreciation rate.

Depreciation 462500 x 10100 46250. The asset is expected to have a. Use the following steps to calculate monthly straight-line depreciation.

On 01042017 Machinery purchased for Rs 1100000- and paid for transportation charge 150000- to install. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

Double Declining Balance Depreciation Method. The company wants to depreciate the machine using the diminishing balance depreciation method with a rate of depreciation of 30. If the rate of depreciation.

Diminishing Value Method of Depreciation. Year 2 2000 400 1600 x. The diminishing balance depreciation method also results in a lower depreciation expense in.

2000 - 500 x 30 percent 450. The double declining balance depreciation method is one of two common methods a business uses to account for the. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

Cost value diminishing value rate amount of depreciation to. Closing balance opening balance depreciation amount. Consider the initial cost of an equipment is Rs.

Year 1 2000 x 20 400. Subtract the assets salvage value from its cost to determine the amount that can be depreciated. The diminishing balance method of depreciation or as it is also known the reducing balance.

With the diminishing balance method depreciation is calculated as a percentage on the book. Closing balance opening balance. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years.

Depreciation Rate 60 Therefore the solution will be. Prime cost straight line method. Diminishing value It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10 May.

Depreciation Formula Examples With Excel Template

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Depreciation Diminishing Value Method Youtube

Written Down Value Method Of Depreciation Calculation

Which Depreciation Method Is Best For You Real Estate Consumer Network

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Working From Home During Covid 19 Tax Deductions Guided Investor

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Depreciation Formula Calculate Depreciation Expense

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Straight Line Vs Reducing Balance Depreciation Youtube

Depreciation All Concepts Explained Oyetechy

Depreciation Formula Calculate Depreciation Expense

Written Down Value Method Of Depreciation Calculation

Declining Balance Depreciation Calculator